When you experience a collision, the stress and uncertainty can feel overwhelming. Whether you’re a long-time resident of British Columbia or new to the ICBC insurance system, understanding your collision repair coverage can seem like deciphering a complex puzzle.

This guide is designed to walk you through every step, from knowing what your coverage includes to finding an ICBC-approved repair shop, so you can confidently manage your claim.

Think of this process like navigating a well-marked hiking trail: with clear signs and helpful tips along the way, you can reach your destination with ease and peace of mind.

What is ICBC collision repair coverage?

ICBC collision repair coverage is a type of insurance designed to help you pay for repairs after a vehicle collision. It acts as a financial safety net, making sure that you do not shoulder all the repair expenses alone.

This coverage can pay for damages to your vehicle, and in many cases, it also assists with towing and storage costs following an accident. Understanding your coverage is essential because it not only helps protect your wallet but also gives you peace of mind when unexpected incidents occur.

The details might feel confusing for many drivers, especially first-time claimants or recent immigrants still getting acquainted with BC’s insurance landscape.

However, once you know what is included and how the process works, it’s much like following a simple recipe, as each ingredient plays a part in delivering a secure outcome. In the sections that follow, we’ll break down the process step-by-step and help you understand the finer points of your ICBC collision repair coverage.

Why is ICBC collision repair coverage essential?

ICBC collision insurance helps pay for vehicle repairs resulting from accidents, regardless of fault. Here’s what it typically covers:

- Repair Costs: Covers the cost of parts and labor for vehicle restoration.

- Towing Fees: If your vehicle is inoperable, towing to an ICBC-approved repair shop is covered.

- Storage Costs: If your vehicle requires temporary storage before repairs, fees may be included.

- Vehicle Replacement (if total loss): If the car is beyond repair, ICBC provides compensation based on its market value.

Policyholders are responsible for a deductible, the amount paid out-of-pocket before insurance kicks in. Higher deductibles often mean lower premiums, so choosing the right balance is important. Understanding insurance deductibles is key to making an informed decision about your coverage.

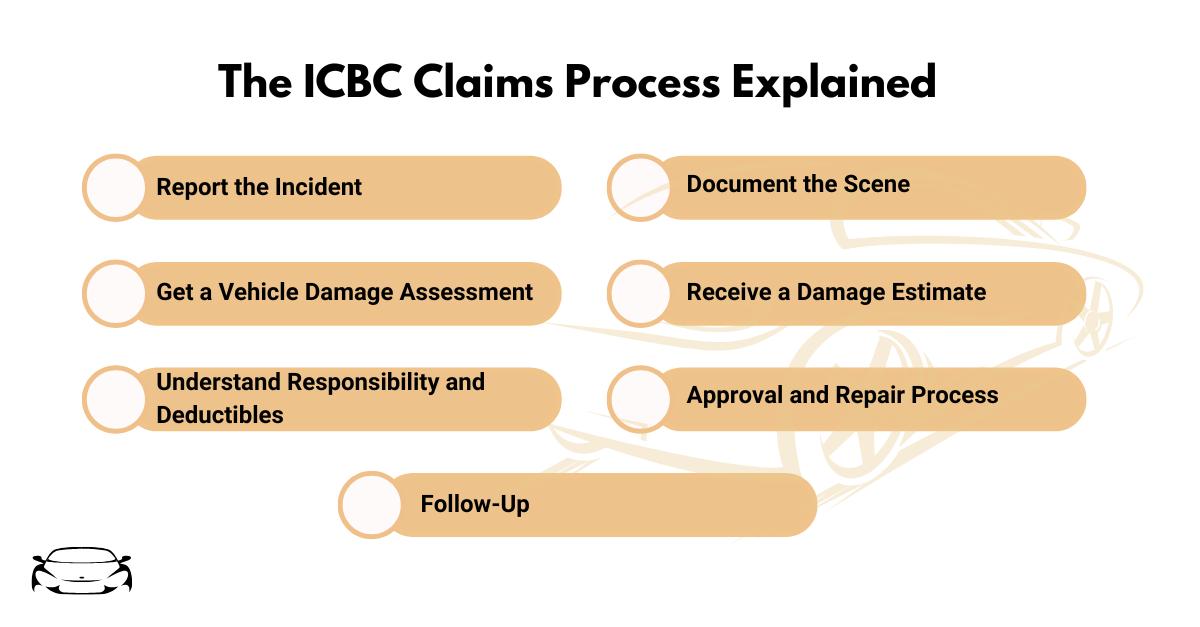

The ICBC Claims Process

Navigating the ICBC claims process might seem daunting at first, but breaking it down into clear steps can simplify everything. Here’s a step-by-step guide to help you file a collision claim:

1. Report the Incident

As soon as it’s safe, notify ICBC about the collision. You can do this via phone or through their online portal. Make sure to have all relevant details, including the time, location, and a brief description of what happened.

2. Document the Scene

It is crucial to collect as much evidence as possible. Take photos of the damages, the surrounding area, and any other vehicles involved. If there were witnesses, gather their contact information. This documentation supports your claim and helps speed up the process.

3. Get a Vehicle Damage Assessment

After reporting the incident, schedule a vehicle damage assessment. This step is key, as a thorough damage assessment will determine the extent of repairs needed. This evaluation forms the basis for the repair cost estimate.

4. Receive a Damage Estimate

Once the assessment is complete, you’ll receive a damage estimate. This estimate outlines the cost of repairs and is a critical document during the claim process. It ensures that you’re aware of the expenses covered under ICBC collision repair coverage.

5. Understand Responsibility and Deductibles

The assessment will also help determine responsibility. Depending on the findings, you might be liable for part of the costs, including the ICBC insurance deductible. Familiarize yourself with the details of your policy, including any deductibles and limits.

6. Approval and Repair Process

After the claim is approved, you’ll be directed to an ICBC-approved repair shop to begin the repair work. Using an accredited facility ensures that the repairs meet ICBC standards. This step is essential for a smooth process and helps guarantee that your vehicle is restored correctly.

7. Follow-Up

Keep a record of every communication with ICBC and the repair shop. Regular follow-ups can help ensure that your claim is processed quickly and accurately. If you have any questions during the process, don’t hesitate to ask for clarification from your ICBC representative.

By breaking down the process into these clear steps, filing a claim becomes less intimidating and much more manageable. Remember, the goal is to restore your vehicle and get you back on the road safely. Understanding ICBC collision claim steps can help make this process even smoother.

Finding ICBC-Approved Repair Shops

Choosing the right repair shop is essential to ensure quality and compliance with ICBC standards. Here are some tips for finding ICBC-approved repair shops:

Check the ICBC Website

The official ICBC website maintains a list of accredited repair facilities. These ICBC-approved repair shops have met strict standards to ensure quality repairs and customer satisfaction.

Read Reviews and Get Recommendations

Look for customer reviews on platforms like Yelp or Google Reviews. Real experiences from other drivers can help you make an informed decision. Asking friends or family members for recommendations can also be valuable.

Visit the Shop

Visit the repair shop before committing. A clean, organized shop with knowledgeable staff can give you confidence that your car will be in good hands.

Ask About Warranties

Many ICBC-approved repair shops offer warranties for their work. This means if any issues arise after the repair, you have recourse. It’s a bit like buying a trusted product that comes with a guarantee.

Choosing an approved facility ensures that your repairs are done to the highest standards. It minimizes the risk of further complications and supports a smoother, faster claims process.

Understanding your ICBC insurance options can also help you make informed decisions about coverage levels, deductibles, and additional benefits that might be available.

What are the most common mistakes to avoid?

Even with a clear process, there are a few common mistakes that can delay your claim or increase your out-of-pocket expenses. Here are some pitfalls to avoid:

- Delaying the Report – Waiting too long to report an accident can complicate your claim. Always notify ICBC as soon as possible.

- Incomplete Documentation – Failing to document the incident thoroughly may result in disputes over damage assessments. Always take detailed photos and notes.

- Skipping the Approved Shop – Opting for a non-approved repair shop might lead to substandard repairs or issues with claim approval. Stick to ICBC-approved repair shops for guaranteed service.

- Ignoring Policy Details – Not fully understanding your policy, including your deductible and coverage limits, can lead to unexpected costs. Read your policy carefully or ask questions if you’re unsure.

Tips for a Smooth Claims Experience

Here are some practical tips to ensure your claims experience is as smooth as possible:

- Keep Detailed Records – Maintain a file with all related documents, including photos, police reports, and correspondence with ICBC. This record will be invaluable if any issues arise.

- Ask Questions – Never hesitate to ask your ICBC representative for clarification. Understanding every step can help you avoid surprises later.

- Stay Organized – Keep track of dates, appointments, and follow-ups. A little organization can make a big difference in ensuring your claim moves forward without delays.

- Know Your Policy – Familiarize yourself with your coverage details, including your deductible and any Enhanced Care benefits. Being informed is the best way to navigate the process smoothly.

- Be Patient – Remember, processing claims can take time. Keeping a calm and patient demeanor can help you manage the stress during this period.

Think of your claim like a well-organized journey—every detail matters, and being prepared ensures you reach your destination with minimal bumps along the way.

Frequently Asked Questions for First-Time Claimants

Here are five common questions that many first-time claimants ask:

What does ICBC collision coverage include?

ICBC collision coverage typically includes repair costs for your vehicle, towing, storage fees, and sometimes even temporary transportation. However, specific benefits depend on your policy details.

How do I file a collision claim with ICBC?

Start by reporting the incident immediately, then document the scene, schedule a vehicle damage assessment, and follow the steps provided by your ICBC representative. Each step is designed to guide you through the process smoothly.

Do I have to use an ICBC-approved repair shop?

Yes, using an ICBC-approved repair shop is important. These shops meet the required standards for quality and reliability, ensuring your repairs are performed correctly and in a timely manner.

Will a collision claim affect my ICBC insurance premiums?

Filing a claim can potentially impact your insurance premiums. However, the exact effect depends on several factors, including your driving history and the specifics of your policy.

What is the deductible for ICBC collision coverage?

The deductible is the amount you must pay out-of-pocket before your insurance covers the rest. This amount varies depending on your policy and can be reviewed in your policy documents or by contacting your ICBC representative.

Final Thoughts

Navigating ICBC collision repair coverage doesn’t have to be overwhelming. With a clear understanding of your policy, the claims process, and the importance of using ICBC-approved repair shops, you can manage your claim with confidence.

Remember, this guide is here to help you every step of the way—from the moment an accident occurs to the completion of repairs.

By keeping these guidelines in mind and following the detailed steps outlined above, you can navigate the ICBC collision repair coverage process with ease and confidence. Enjoy a safer journey knowing you have the right support when you need it most.